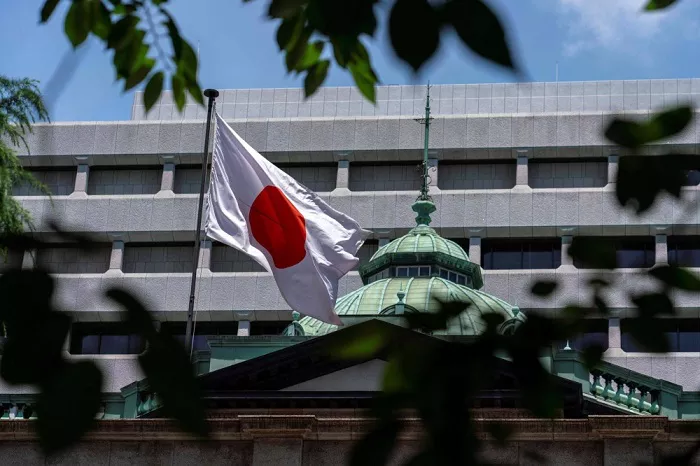

Japan’s central bank announced on Tuesday that it will slow down its reduction of government bond purchases starting April next year. At the same time, it kept the benchmark interest rate steady at 0.5% amid growing concerns over economic growth.

The Bank of Japan’s decision matched economists’ expectations surveyed by Reuters. The central bank confirmed it will continue cutting its quarterly purchases of Japanese government bonds (JGBs) by about 400 billion yen ($2.76 billion), reaching around 3 trillion yen monthly by March 2026, according to last year’s plan.

From April 2026 to March 2027, the BOJ will reduce the pace of cuts to 200 billion yen per quarter. The goal is to lower monthly bond purchases to approximately 2 trillion yen by then.

The central bank also plans to review its policy again at the June 2026 monetary meeting.

The BOJ said this gradual approach aims to improve the functioning of the JGB market, ensuring stability and smooth operations.

It expects monthly JGB purchases to average about 4.1 trillion yen during the quarter ending June 2025.

Following the announcement, Japan’s Nikkei 225 index rose 0.55%, and the yen strengthened by 0.13%, trading at 144.55 against the U.S. dollar. The 10-year JGB yield increased by 3 basis points to 1.491%.