At the heart of its regulatory efforts lies the establishment of prudential norms and regulations for banks. Take, for instance, the capital adequacy requirements. These are not mere arbitrary rules; they are meticulously calculated and designed safeguards that ensure banks maintain a sufficient buffer of funds. This buffer acts as a financial shock absorber, enabling banks to weather various economic storms, whether they stem from sudden market downturns, unexpected loan defaults, or global financial upheavals. By mandating that banks maintain a certain level of capital in proportion to their risk – weighted assets, the RBI provides a safety net that instills confidence in depositors and investors alike.

Monetary Policy Formulation and Implementation

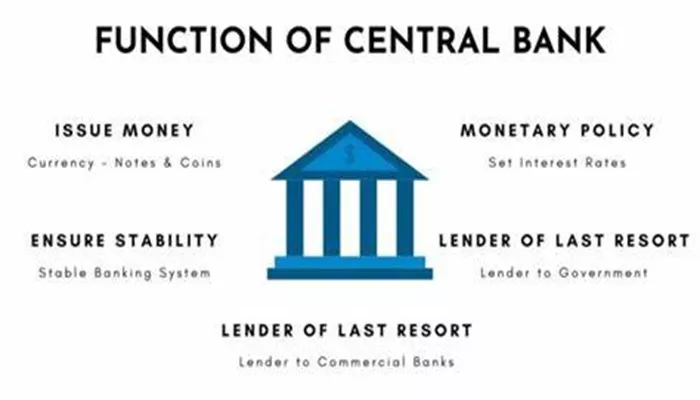

One of the primary roles of the RBI is to formulate and implement monetary policy. Monetary policy refers to the actions taken by the central bank to control the supply of money and credit in the economy in order to achieve certain macroeconomic objectives. The RBI’s monetary policy objectives include maintaining price stability, ensuring adequate liquidity in the market, and promoting economic growth.

The RBI uses a variety of tools to implement monetary policy. These tools include repo rate, reverse repo rate, cash reserve ratio (CRR), statutory liquidity ratio (SLR), and open market operations (OMO). The repo rate is the rate at which the RBI lends money to commercial banks, while the reverse repo rate is the rate at which the RBI borrows money from commercial banks. The CRR is the percentage of deposits that commercial banks are required to keep with the RBI, while the SLR is the percentage of deposits that commercial banks are required to invest in government securities. OMO involves the buying and selling of government securities by the RBI in the open market to control the supply of money and credit in the economy.

By adjusting these policy rates and ratios, the RBI can influence the cost and availability of credit in the economy. For example, if the RBI increases the repo rate, it becomes more expensive for commercial banks to borrow money from the RBI. This, in turn, leads to an increase in the interest rates charged by commercial banks on loans to businesses and households. As a result, borrowing becomes more expensive, and businesses and households may reduce their borrowing and spending, which helps to control inflation.

Banker to the Government

The RBI also acts as the banker to the government. This means that the RBI manages the government’s accounts, issues and manages government securities, and provides financial advice to the government. The RBI acts as the custodian of the government’s cash balances and manages the government’s borrowing program.

The RBI also plays a key role in the implementation of the government’s fiscal policy. Fiscal policy refers to the government’s spending and revenue policies. The RBI works closely with the government to ensure that the government’s borrowing program is carried out smoothly and at a reasonable cost. The RBI also provides advice to the government on various financial matters, such as debt management, fiscal consolidation, and economic policy.

Banker’s Bank

In addition to being the banker to the government, the RBI also acts as the banker’s bank. This means that the RBI provides banking services to commercial banks and other financial institutions. The RBI holds the cash reserves of commercial banks and provides them with emergency liquidity support when needed. The RBI also acts as a clearinghouse for interbank transactions, which helps to ensure the smooth functioning of the payment system.

The RBI also regulates and supervises commercial banks and other financial institutions. The RBI sets the regulatory framework for banks and financial institutions and monitors their compliance with these regulations. The RBI also conducts regular inspections of banks and financial institutions to ensure that they are operating in a safe and sound manner.

Currency Issuance and Management

The RBI is responsible for the issuance and management of the Indian currency. The RBI has the sole authority to issue currency notes in India. The RBI ensures that an adequate supply of currency notes is available in the economy to meet the demand for cash. The RBI also manages the circulation of currency notes and coins and withdraws damaged and soiled notes from circulation.

The RBI also plays a key role in maintaining the integrity of the currency. The RBI takes various measures to prevent the counterfeiting of currency notes. The RBI also regularly introduces new security features in currency notes to make them more difficult to counterfeit.

Foreign Exchange Management

The RBI is also responsible for the management of foreign exchange reserves. The RBI manages India’s foreign exchange reserves to ensure that the country has sufficient foreign currency to meet its external obligations. The RBI also intervenes in the foreign exchange market to stabilize the exchange rate of the Indian rupee.

The RBI uses a variety of tools to manage foreign exchange reserves. These tools include buying and selling foreign currency in the open market, adjusting the interest rates on foreign currency deposits, and entering into swap agreements with other central banks. The RBI also sets the exchange rate policy for the Indian rupee and determines the exchange rate at which the rupee is allowed to fluctuate against other currencies.

Financial System Supervision

The RBI is the primary regulator and supervisor of the Indian financial system. The RBI is responsible for ensuring the stability and soundness of the financial system. The RBI sets the regulatory framework for banks, non-banking financial companies (NBFCs), and other financial institutions and monitors their compliance with these regulations.

The RBI also conducts regular inspections of banks and financial institutions to ensure that they are operating in a safe and sound manner. The RBI has the power to take corrective action against banks and financial institutions that violate the regulations. The RBI also plays a key role in promoting financial inclusion and ensuring that the benefits of economic growth are shared by all sections of society.

Conclusion

In conclusion, the Reserve Bank of India plays a crucial role in the Indian economy and financial system. The RBI is responsible for formulating and implementing monetary policy, acting as the banker to the government and the banker’s bank, issuing and managing the currency, managing foreign exchange reserves, and supervising the financial system. The RBI’s actions have a significant impact on the economy, and its policies and decisions are closely watched by market participants, policymakers, and the public. The RBI’s role in maintaining price stability, ensuring financial stability, and promoting economic growth is essential for the long-term development and prosperity of the country.

Related topics

- Current USD Exchange Rate: 300 Dollars to Rupees

- Current USD Exchange Rate: 1600 Dollars to Indian Rupees

- California Currency vs Indian Rupees: Which Is Cheaper?