When it comes to businesses, the repo rate has a profound impact on their operations. It directly influences the cost of borrowing. If the repo rate goes up, businesses will find it more expensive to take out loans to finance their expansion plans. This could cause a company to delay building a new factory, purchasing advanced machinery, or entering new markets. Moreover, the hiring decisions of businesses are also tied to the repo rate. Higher borrowing costs may force a company to cut back on recruitment, as they try to manage their tightened budgets. In a globalized marketplace, where competition is fierce, the cost of borrowing affected by the repo rate can determine a company’s overall competitiveness. A business that can access cheaper capital due to a lower repo rate may be able to offer more competitive prices, invest more in research and development, or expand more rapidly than its rivals.

The Reserve Bank of India: A Brief Overview

The RBI, established in 1935, is India’s central bank. It has multiple functions that are essential for the smooth functioning of the economy.

Monetary Policy Formulation

The RBI is responsible for formulating, implementing, and monitoring the monetary policy of the country. Monetary policy refers to the actions taken by the central bank to manage the supply of money and credit in the economy. This is done with the twin objectives of controlling inflation and promoting economic growth.

Bank Supervision

It also has the task of managing and supervising the operations of banks and the overall financial system. This ensures the stability and integrity of the banking sector, protecting the interests of depositors and maintaining confidence in the financial system.

Currency Issuance

The RBI has the exclusive right to issue currency in India. It ensures an adequate supply of currency notes and coins in the economy while also maintaining the quality and integrity of the currency.

Foreign Exchange Management

Another important function is foreign exchange control and management. The RBI manages India’s foreign exchange reserves and facilitates international trade and payments. It also tries to maintain stability in the foreign exchange market.

Defining the Repo Rate

The repo rate, short for repurchase rate, is the rate at which the RBI lends money to commercial banks in the country for a short – term period. When commercial banks face a shortage of funds, they can borrow from the RBI. To secure this loan, the commercial banks offer securities, such as government treasury bills, to the RBI. It is important to note that this is a repurchase agreement. The banks agree to repurchase these securities from the RBI at a later date, at a pre – determined price. This pre – determined price includes the principal amount borrowed plus the interest charged at the repo rate.

For example, if a commercial bank needs Rs. 100 crore to meet its short – term liquidity requirements, it may offer government securities worth Rs. 100 crore to the RBI. If the repo rate is 6%, after a certain period (usually overnight or for a few days), the bank will have to repurchase the securities for Rs. 100 crore + (Rs. 100 crore * 6% * the period of borrowing in years).

The Functioning of the Repo Rate

Liquidity Provision

The primary function of the repo rate is to provide liquidity to the banking system. During times of financial stress or when there is a short – term shortage of funds in the banking sector, commercial banks turn to the RBI. By borrowing at the repo rate, banks can ensure that they have enough funds to meet their day – to – day operational requirements, such as honoring customer withdrawals, making inter – bank payments, and extending credit to businesses and individuals.

Controlling Inflation

The repo rate is also a powerful tool for controlling inflation. When the RBI wants to curb inflation, it increases the repo rate. An increase in the repo rate makes borrowing more expensive for commercial banks. As a result, banks increase the interest rates they charge on loans to businesses and individuals. Higher loan interest rates discourage borrowing for investment and consumption purposes. With less money being spent in the economy, the demand for goods and services decreases. This, in turn, helps to bring down prices and control inflation.

Conversely, when the RBI wants to boost economic growth, it may decrease the repo rate. A lower repo rate reduces the cost of borrowing for banks. Banks then pass on these lower costs to borrowers in the form of lower loan interest rates. This encourages businesses to invest in new projects, expand their operations, and hire more workers. It also encourages consumers to take out loans for big – ticket purchases like homes and cars, thereby increasing the overall demand in the economy and stimulating growth.

Impact of the Repo Rate on Different Sectors

Banking Sector

For commercial banks, the repo rate has a direct impact on their cost of funds. When the repo rate increases, banks’ borrowing costs from the RBI go up. To maintain their profit margins, banks increase the interest rates on deposits to attract more funds from the public. At the same time, they also raise the interest rates on loans. This can lead to a slowdown in loan demand as borrowers find it more expensive to borrow.

On the other hand, when the repo rate decreases, banks’ borrowing costs from the RBI come down. They can then offer lower interest rates on loans, which may stimulate borrowing and lending activities. However, they may also reduce the interest rates on deposits, which can affect savers.

Business Sector

For businesses, the repo rate has a significant bearing on their investment decisions. When the repo rate is high, the cost of borrowing for businesses is also high. This can discourage businesses from taking on new projects, expanding their production capacity, or investing in research and development. High borrowing costs can also increase the financial burden on existing businesses, especially those with high levels of debt.

In contrast, when the repo rate is low, businesses can borrow at lower interest rates. This makes it more attractive for them to invest in new machinery, technology, and infrastructure. Lower borrowing costs can also improve the profitability of businesses, as they have to pay less in interest on their loans.

Household Sector

For households, the repo rate affects both borrowing and saving decisions. When the repo rate is high, the interest rates on home loans, car loans, and personal loans also increase. This can make it more difficult for households to afford a new home or car. High interest rates on loans can also lead to an increase in the monthly EMI (Equated Monthly Installment) payments for existing borrowers, putting a strain on their finances.

On the savings side, higher repo rates usually lead to higher interest rates on bank deposits. This can be beneficial for savers, especially those who rely on interest income from their deposits. However, if the inflation rate is also high, the real return on savings (adjusted for inflation) may still be low.

When the repo rate is low, households can take out loans at lower interest rates. This can make it more affordable to buy a home or a car. But on the savings front, lower repo rates mean lower interest rates on deposits, which can reduce the income of savers.

Factors Influencing the RBI’s Decision on Repo Rate

Inflation

Inflation is one of the most important factors considered by the RBI when deciding on the repo rate. If the inflation rate is rising above the RBI’s target level, it is likely to increase the repo rate to curb inflation. The RBI uses various inflation indices, such as the Consumer Price Index (CPI) and the Wholesale Price Index (WPI), to monitor inflation trends.

Economic Growth

The state of the economy also plays a crucial role. If the economy is growing at a slow pace, with low levels of investment and consumption, the RBI may lower the repo rate to stimulate economic activity. On the other hand, if the economy is overheating, with high levels of inflationary pressures due to excessive demand, the RBI may raise the repo rate.

Global Economic Conditions

Global economic conditions can also impact the RBI’s decision on the repo rate. For example, if there is a global economic slowdown, it can affect India’s exports and economic growth. In such a scenario, the RBI may consider lowering the repo rate to boost domestic demand and offset the negative impact of the global slowdown. Similarly, if there are significant changes in global interest rates, it can influence the RBI’s decision – making process.

Fiscal Policy

The fiscal policy of the government, which includes government spending and taxation, can also have an impact on the repo rate. If the government is running a large fiscal deficit and is borrowing heavily from the market, it can put upward pressure on interest rates. The RBI may then have to adjust the repo rate to maintain stability in the financial system.

Comparison with Reverse Repo Rate

The reverse repo rate is the rate at which the RBI borrows money from commercial banks. It is the opposite of the repo rate. When the RBI wants to absorb excess liquidity from the market, it increases the reverse repo rate. This makes it more attractive for commercial banks to park their surplus funds with the RBI, as they can earn a higher return. As a result, the amount of money available for lending in the market decreases, which helps to control inflation.

Conversely, when the RBI wants to inject more liquidity into the market, it may lower the reverse repo rate. This encourages banks to lend more money to businesses and individuals, rather than keeping it with the RBI. The reverse repo rate is usually lower than the repo rate, as the RBI wants to encourage banks to lend money in the economy rather than just parking it with the central bank.

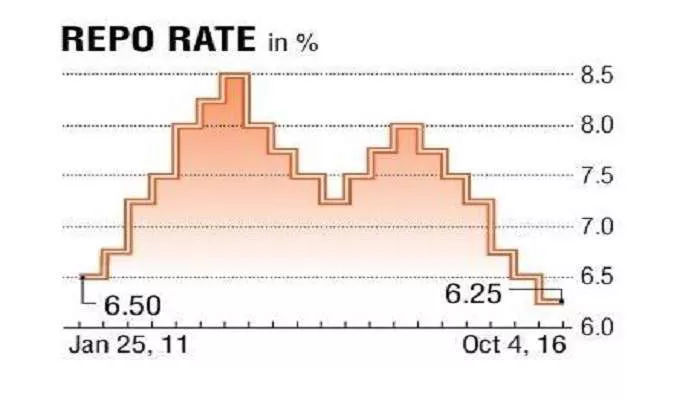

Historical Trends of the RBI’s Repo Rate

Over the years, the RBI’s repo rate has fluctuated in response to changing economic conditions. In the early 2000s, the repo rate was in the range of 4 – 6%. During the global financial crisis of 2008 – 2009, the RBI significantly reduced the repo rate to boost economic growth. It reached a low of around 4% in 2020 as the COVID – 19 pandemic hit the Indian economy hard, leading to a slowdown in economic activity.

In recent times, as the economy has started to recover and inflation has been a concern, the RBI has adjusted the repo rate accordingly. In 2022 – 2023, there were several hikes in the repo rate to combat rising inflation. In 2025, due to a combination of factors such as easing inflation and a need to support economic growth in the face of global trade tensions, the RBI has started to lower the repo rate. For instance, in February 2025, the RBI lowered the repo rate by 25 basis points to 6.25%, and in April 2025, it was further reduced to 6%.

Conclusion

The RBI’s bank repo rate is a critical component of India’s monetary policy. It serves as a powerful tool for the central bank to manage liquidity, control inflation, and stimulate economic growth. The repo rate has a far – reaching impact on various sectors of the economy, including the banking sector, businesses, and households. By understanding the repo rate and its implications, investors, businesses, and individuals can make more informed financial decisions.

The RBI’s decision – making process regarding the repo rate is complex and takes into account multiple factors, both domestic and global. As the Indian economy continues to evolve, the repo rate will remain a key instrument in the RBI’s efforts to maintain economic stability and promote sustainable growth. Whether it is to combat inflationary pressures or to boost a sluggish economy, the repo rate will continue to play a central role in shaping India’s economic future.

Related topics

- What Is the Exchange Rate for Gbp to Aud?

- Current USD Exchange Rate: $5000 US in Australian Dollars

- Current USD Exchange Rate: $89 USD in Australian Dollars