Investing in financial institutions often raises questions about safety and reliability. UBS Group AG, a Swiss multinational investment bank and financial services company, is one of the world’s leading banks. With a rich history and a vast network, many investors wonder: Is UBS a safe place for your money? This article examines various aspects of UBS, including its financial stability, regulatory environment, and services, to provide a comprehensive overview of its safety as an investment option.

Overview of UBS

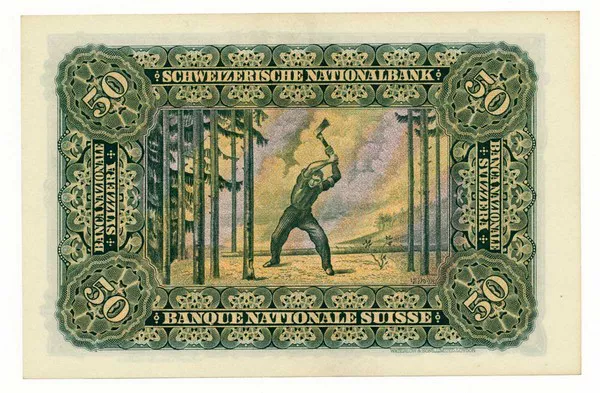

Founded in 1862, UBS has evolved into a global powerhouse in banking and financial services. Headquartered in Zurich, Switzerland, the bank operates in over 50 countries and employs more than 70,000 people. UBS offers a wide range of services, including wealth management, investment banking, asset management, and retail banking.

The bank is publicly traded on the Swiss Stock Exchange and is considered one of the “too big to fail” institutions. This status implies that UBS is crucial to the financial system and that governments would likely intervene to prevent its collapse.

Financial Stability

Capital Adequacy

One of the primary measures of a bank’s safety is its capital adequacy ratio (CAR). This ratio indicates a bank’s capital in relation to its risk-weighted assets. UBS has consistently maintained a strong CAR, often exceeding regulatory requirements. As of the latest reports, UBS’s CAR is well above the minimum threshold set by the Basel III framework, reflecting its ability to withstand financial shocks.

Profitability

UBS has a solid track record of profitability. The bank’s diverse revenue streams, including fees from wealth management and trading activities, contribute to its financial health. A consistent profit margin ensures that UBS can reinvest in its operations, enhance its services, and maintain a robust balance sheet.

Risk Management

Effective risk management is critical in banking. UBS employs sophisticated risk management frameworks to identify, assess, and mitigate potential risks. The bank has made significant investments in technology and analytics to enhance its risk management capabilities. This proactive approach helps protect the bank’s assets and those of its clients.

Regulatory Environment

Swiss Banking Regulations

Switzerland is known for its stringent banking regulations, which are designed to protect depositors and maintain financial stability. UBS is subject to the regulations of the Swiss Financial Market Supervisory Authority (FINMA), which ensures that the bank adheres to high standards of conduct.

The Swiss banking system is often seen as one of the safest in the world, thanks to its robust regulatory framework and the country’s political stability. This environment contributes to UBS’s overall safety as an institution.

International Compliance

As a global entity, UBS must also comply with international banking regulations. The bank adheres to the Basel III standards, which require higher capital ratios and improved risk management practices. Additionally, UBS has implemented measures to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, further enhancing its credibility.

Services Offered by UBS

Wealth Management

UBS is renowned for its wealth management services, catering to high-net-worth individuals and families. The bank offers personalized financial planning, investment strategies, and estate planning services. UBS’s extensive research and global market insights allow clients to make informed decisions about their investments.

Investment Banking

UBS is a significant player in investment banking, providing advisory services, underwriting, and capital market services. The bank’s global presence and expertise in various sectors enable it to support clients effectively, whether they are corporations or institutional investors.

See Also: Is UBS a Tier 1 Bank?

Asset Management

UBS’s asset management division offers a diverse range of investment products and services. The bank manages billions in assets across various asset classes, including equities, fixed income, and alternative investments. Its commitment to responsible investing and sustainability appeals to socially conscious investors.

Retail Banking

In addition to its investment services, UBS offers retail banking solutions, including savings accounts, mortgages, and personal loans. This diversification helps stabilize the bank’s revenue streams and provides clients with a full suite of financial services.

Client Protection Measures

Deposit Insurance

Switzerland has a robust deposit insurance scheme in place to protect depositors. The Swiss Federal Act on Deposit Insurance ensures that deposits up to a certain amount are guaranteed, offering clients peace of mind. In the event of a bank failure, the scheme protects individual deposits, making UBS a secure choice for holding cash.

Client Segmentation

UBS employs a client segmentation strategy that allows it to tailor services to different client needs. By understanding the unique requirements of various client segments, UBS can provide personalized solutions while maintaining a high level of service. This approach fosters long-term relationships and client loyalty.

Recent Developments and Challenges

Market Volatility

The global financial landscape is often subject to market volatility, influenced by factors such as economic indicators, geopolitical events, and interest rates. UBS, like other financial institutions, faces challenges from market fluctuations. However, its diversified business model helps mitigate the impact of such volatility.

Technological Advancements

The rise of fintech and digital banking has transformed the financial services industry. UBS is actively investing in technology to enhance its services and improve client experience. By embracing innovation, the bank aims to stay competitive and adapt to changing client expectations.

Sustainability and ESG Initiatives

Environmental, social, and governance (ESG) considerations are increasingly important to investors. UBS has made a commitment to sustainability, integrating ESG factors into its investment strategies. The bank’s focus on responsible investing aligns with the values of many modern investors, further enhancing its appeal.

Conclusion

When considering whether UBS is a safe place for your money, several factors come into play. The bank’s strong financial stability, robust regulatory environment, diverse services, and commitment to client protection contribute to its overall safety as a financial institution.

While no investment is without risk, UBS has demonstrated resilience and adaptability in a constantly evolving market. For investors seeking a reputable and reliable banking partner, UBS stands out as a strong contender.

Ultimately, the decision to invest in UBS or any financial institution should be based on individual risk tolerance, financial goals, and personal preferences. As always, thorough research and consultation with financial advisors are recommended before making any investment decisions.

Related Topics:

- UBS vs Goldman Sachs: Which is Bigger?

- Is UBS Swiss or German: A Comprehensive Analysis

- Is UBS Financially Stable? A Comprehensive Analysis