In the intricate world of global finance, the exchange rate is a crucial factor that shapes international trade, investment, and economic stability. One currency that often captures attention is the Swiss Franc (CHF), known for its stability and economic significance. In this article, we delve into the current CHF exchange rate, with a specific focus on understanding what 25 CHF translates to in US dollars (USD).

Understanding the Swiss Franc

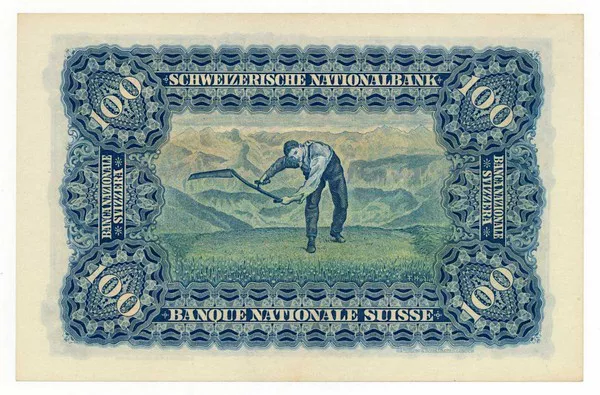

Before we dive into the specifics of the exchange rate, let’s take a moment to understand the Swiss Franc and its role in the global financial landscape. The Swiss Franc, denoted by the symbol CHF, is the official currency of Switzerland and Liechtenstein. Renowned for its stability, the Swiss Franc has long been considered a safe-haven currency, attracting investors during times of economic uncertainty.

The Swiss economy, characterized by a strong banking sector, precision manufacturing, and a robust services industry, contributes to the strength of the Swiss Franc. The country’s commitment to financial prudence and a sound monetary policy has positioned the CHF as a reliable currency in the international market.

Factors Influencing Exchange Rates

Exchange rates are influenced by a myriad of factors, both domestic and international. Understanding these factors is essential for comprehending the dynamics that govern currency valuations. Some of the key determinants include:

1. Economic Indicators

Economic indicators such as GDP growth, unemployment rates, and inflation play a significant role in shaping exchange rates. A robust economy generally strengthens a currency, attracting foreign investment.

2. Interest Rates

Central banks use interest rates as a tool to control inflation and stimulate economic growth. Higher interest rates can make a currency more attractive to investors, leading to an appreciation in its value.

3. Political Stability

Political stability and effective governance contribute to a favorable investment climate. Currencies of politically stable countries are often perceived as safer, attracting foreign capital and influencing exchange rates.

4. Trade Balances

A country’s trade balance, representing the difference between exports and imports, can impact its currency’s value. A trade surplus tends to strengthen a currency, while a deficit may lead to depreciation.

5. Market Sentiment

Investor perception and market sentiment also play a crucial role in determining exchange rates. News, geopolitical events, and economic forecasts can influence how traders perceive a currency’s strength.

Current Swiss Franc to US Dollar exchange rate

As of latest data, the exchange rate between the Swiss Franc (CHF) and the United States Dollar (USD) is 1.13. Using the current exchange rate, we can calculate that 25 Swiss francs can be exchanged for approximately 28.31 US dollars.

Implications for International Travel and Trade

Understanding the value of 25 CHF in USD has practical implications, especially for individuals engaged in international travel or trade. Travelers from Switzerland visiting the United States will need to budget according to the prevailing exchange rate to accurately gauge their expenses in US dollars.

For businesses engaged in cross-border trade between Switzerland and the US, fluctuations in the CHF to USD exchange rate can impact the cost of imports and exports. Therefore, staying informed about exchange rate movements is crucial for effective financial planning and risk management.

Economic Factors Driving CHF-USD Exchange Rate Movements

Several economic factors contribute to the fluctuations in the CHF-USD exchange rate. Analyzing these factors can offer a glimpse into the forces shaping the current valuation of the Swiss Franc against the US dollar.

1. Central Bank Policies

The monetary policies adopted by the Swiss National Bank (SNB) and the US Federal Reserve play a pivotal role in influencing the CHF-USD exchange rate. Interest rate differentials and policy decisions impact investor confidence and, subsequently, the value of the currencies.

2. Economic Data Releases

Regular economic data releases, including GDP growth, employment figures, and trade balances, can influence market sentiment and drive currency movements. Traders closely monitor these indicators for insights into the economic health of both Switzerland and the United States.

See Also:Current CHF Exchange Rate: What Is CHF in JPY?

3. Global Economic Conditions

The interconnected nature of the global economy means that events in other regions can also impact the CHF-USD exchange rate. Economic developments in Europe, Asia, and other major trading partners can have ripple effects on currency valuations.

Strategies for Managing Exchange Rate Risks

Given the inherent volatility in currency markets, individuals and businesses may adopt various strategies to manage exchange rate risks. Some common approaches include:

1. Forward Contracts

Forward contracts allow businesses to lock in a specific exchange rate for a future date, providing certainty in budgeting and financial planning.

2. Hedging Instruments

Financial instruments such as options and futures can be used to hedge against unfavorable exchange rate movements. These instruments offer protection by allowing parties to buy or sell currencies at predetermined prices.

3. Diversification

Diversifying currency holdings can help spread risk and mitigate the impact of adverse exchange rate movements. Holding a mix of currencies can provide a buffer against volatility in any single currency.

Conclusion

In conclusion, understanding the current CHF exchange rate and its implications is essential for individuals and businesses engaged in international transactions. The specific value of 25 CHF to USD provides a practical illustration of the real-world impact of exchange rate fluctuations.

As we navigate the complex world of global finance, it’s crucial to remain vigilant, stay informed about economic indicators, and adopt effective risk management strategies. The CHF-USD exchange rate, with its unique dynamics, reflects the broader economic landscape and serves as a barometer for the health of both the Swiss and US economies.

In an era of increasing interconnectedness, where borders are blurred by trade and finance, grasping the nuances of exchange rates becomes a valuable skill. By staying informed and adapting to the evolving economic landscape, individuals and businesses can navigate the currents of the currency market with confidence.

Related Topics:

Current CHF Exchange Rate: What Is Swiss Franc to Euro?

Current CHF Exchange Rate: What Is Swiss Franc to USD?

Current CHF Exchange Rate: What Is 50,000 CHF to GBP?