In this comprehensive article, we are about to embark on an in – depth exploration of all aspects related to the Reserve Bank of India. We will not only take a detailed look at its origins, historical development, and the legal framework that governs its operations but also dissect its wide – ranging functions. These functions include formulating and implementing monetary policy, regulating and supervising the banking sector, managing the country’s foreign exchange reserves, and ensuring the stability of the financial system. Moreover, we will also delve into the question of whether there could be a central – bank – like presence in Raipur. We will investigate if there are any legitimate RBI branches or offices in the city, and if not, what other financial institutions might be operating under a similar guise, understanding the implications of such potential misperceptions in the local financial ecosystem.

What is the Reserve Bank of India?

The Reserve Bank of India (RBI) is India’s central bank. It was established on April 1, 1935, in accordance with the Reserve Bank of India Act, 1934. Initially, it was privately owned, but in 1949, it was nationalized and has since been fully owned by the Government of India with a capital of Rs. 50 million.

Functions of the RBI

Monetary Policy Formulation and Implementation: The RBI’s primary function is to formulate and implement monetary policy. This involves managing the money supply in the economy to achieve certain goals. One of the main goals is to maintain price stability. By controlling inflation, the RBI aims to ensure that the value of the Indian rupee remains relatively stable. For example, if inflation is rising too fast, the RBI may increase interest rates. Higher interest rates make borrowing more expensive, which reduces the amount of money people and businesses can borrow and spend. This, in turn, cools down the economy and helps to bring down inflation.

Another aspect of monetary policy is ensuring the availability of credit to productive sectors of the economy. The RBI tries to balance the need for economic growth (which requires credit) and price stability. It uses various tools such as the repo rate (the rate at which the RBI lends money to commercial banks), the reverse repo rate (the rate at which the RBI borrows money from commercial banks), and cash reserve ratio (the percentage of deposits that banks must keep with the RBI) to influence the money supply and interest rates in the market.

Regulation and Supervision of the Financial System: The RBI is responsible for regulating and supervising commercial banks, financial institutions, and non – bank financial companies in India. It sets rules and regulations regarding their operations, capital adequacy, and lending practices. For instance, it mandates that banks maintain a certain level of capital to cover potential losses. This ensures the stability of the banking system and protects the interests of depositors.

The RBI also conducts regular inspections of banks to check their compliance with these regulations. In case of any irregularities or financial distress, the RBI can take corrective actions. It can ask banks to improve their financial health, merge with stronger banks, or in extreme cases, even revoke a bank’s license if it poses a significant risk to the financial system.

Currency Issuance: The RBI has the sole right to issue currency notes in India, except for one – rupee notes and coins. It manages the printing, distribution, and replacement of currency notes. This is crucial for maintaining the integrity of the currency. The RBI ensures that an adequate supply of clean and genuine currency is available in the economy. It also has measures in place to detect and prevent the circulation of counterfeit currency. For example, it constantly updates the security features of currency notes, such as watermarks, security threads, and intaglio printing, and educates the public about these features.

Foreign Exchange Management: India has a vibrant international trade and investment landscape. The RBI manages the country’s foreign exchange reserves. These reserves are used to maintain the stability of the Indian rupee in the foreign exchange market. If the value of the rupee is falling too rapidly, the RBI can sell foreign currency from its reserves in the market. This increases the supply of foreign currency and reduces the supply of rupees, thereby stabilizing the rupee’s value.

The RBI also formulates policies related to foreign exchange transactions. It regulates the inflow and outflow of foreign capital, such as foreign direct investment (FDI) and foreign portfolio investment (FPI). For example, it sets limits on how much foreign investors can invest in different sectors of the Indian economy.

Banker to the Government: The RBI acts as a banker to the central and state governments in India. It manages the government’s accounts, handles its receipts and payments, and helps in the borrowing program of the government. When the government needs to raise funds, it issues bonds. The RBI plays a key role in the underwriting and distribution of these government bonds. It also provides short – term loans to the government to meet its temporary cash flow requirements.

Banker’s Bank: Commercial banks in India keep a certain portion of their deposits with the RBI as reserves. The RBI provides various services to these banks. It acts as a lender of last resort. In times of financial stress, when commercial banks are unable to raise funds from other sources, they can approach the RBI for emergency loans. This helps to prevent bank runs and maintain the stability of the banking system.

The RBI also facilitates inter – bank transactions. For example, when one bank needs to transfer funds to another bank, the RBI’s clearinghouse services are used to settle these transactions efficiently.

Organizational Structure of the RBI

Central Board: The affairs of the RBI are governed by a Central Board. The members of the Central Board are appointed by the central government. The board consists of a governor, up to four deputy governors, ten directors from various fields (such as industry, trade, and finance), one government official, and four directors elected by the regional boards. The Central Board meets at least six times a year, with at least one meeting per quarter. It is responsible for formulating the overall policies and strategies of the RBI.

Regional Boards: The RBI has four regional boards located in Mumbai, Kolkata, Chennai, and New Delhi. Each regional board has five members who are appointed by the central government for a term of four years. These regional boards provide valuable input on regional economic and financial issues. They also help in the implementation of RBI policies at the regional level and represent the interests of regional cooperative banks and local banks.

Departments: The RBI has numerous departments to carry out its functions effectively. Some of the important departments include the Monetary Policy Department, which is responsible for formulating and implementing monetary policy; the Banking Regulation Department, which regulates and supervises banks; the Foreign Exchange Department, which manages foreign exchange reserves and formulates foreign exchange policies; and the Economic Analysis and Policy Department, which conducts research and analysis on economic trends in India.

RBI’s Presence in Raipur

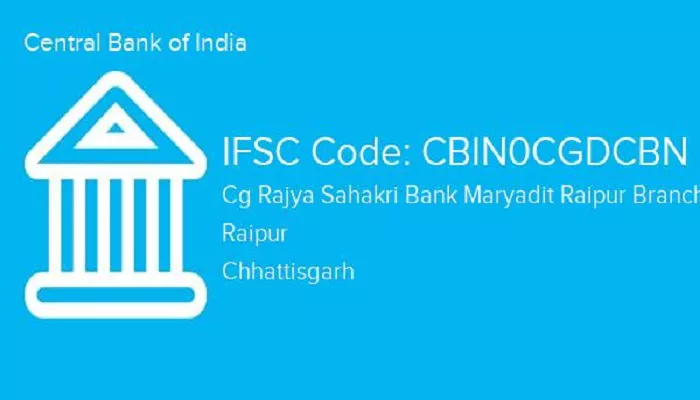

Raipur is an important city in Chhattisgarh. However, the Reserve Bank of India does not have its main regional office in Raipur. The four main regional offices of the RBI are located in Mumbai, Kolkata, Chennai, and New Delhi. But this does not mean that there is no RBI – related activity in Raipur.

Authorized Banks: Commercial banks in Raipur operate under the regulations set by the RBI. These banks follow the RBI’s guidelines regarding interest rates, lending norms, and deposit – taking. For example, when a person in Raipur opens a savings account in a bank, the bank has to comply with the RBI – mandated minimum interest rate on savings accounts.

Banks in Raipur also participate in the RBI – regulated payment systems. Whether it is a simple ATM withdrawal or a large – value inter – bank transfer, the transactions are processed in accordance with the rules and systems set up by the RBI.

RBI – Sponsored Programs: There may be RBI – sponsored financial inclusion programs being implemented in Raipur. These programs aim to bring more people in the region under the formal banking net. For example, initiatives to provide basic banking services to rural and semi – urban areas near Raipur are often driven by the RBI’s policies. Local banks in Raipur may be involved in implementing these programs, such as opening no – frills accounts for people with low incomes.

Conclusion

In addition to regulatory oversight, the RBI’s impact is also keenly felt through the implementation of comprehensive financial inclusion programs in the region. Recognizing the importance of providing access to financial services for all segments of society, the RBI has initiated several initiatives aimed at extending banking services to the unbanked and underbanked populations in Raipur and other parts of India. These programs include the establishment of new bank branches, the promotion of digital banking and mobile payments, and the introduction of innovative financial products and services tailored to the specific needs of rural and low – income communities. Through these efforts, the RBI is not only expanding financial access but also empowering individuals and businesses to participate more fully in the economic mainstream, thereby contributing to the overall development and prosperity of the region.

Related topics

- Who Controls the Reserve Bank of India?

- Does RBI Control All Banks in India?

- What is the 5000 Rupee Banknote in India?