Currency exchange is the process of converting one country’s currency into another. When it comes to converting the US dollar (USD) to the Indian rupee (INR), it’s essential to understand the fundamental concepts behind this exchange. The exchange rate is the key factor that determines how many Indian rupees you will get for one US dollar. It’s like a price tag that shows the value of one currency in terms of another.

There are two main types of exchange rates: the spot rate and the forward rate. The spot rate is the current exchange rate at which a currency can be bought or sold for immediate delivery. When you walk into a currency exchange booth or use an online currency exchange service to convert your dollars to rupees right away, This is often used by businesses that want to hedge against currency fluctuations. For instance, if an Indian company knows it will receive payment in US dollars three months from now, it might enter into a forward contract to sell those dollars at a pre – determined forward rate to avoid potential losses due to a fall in the value of the dollar against the rupee.

Economic Indicators

Inflation Rates

Inflation plays a crucial role in determining exchange rates. If the inflation rate in the United States is lower than that in India, the value of the US dollar is likely to increase relative to the Indian rupee. This is because goods and services in the US become relatively cheaper compared to those in India. As a result, there will be a higher demand for US dollars, driving up its value. For example, if the inflation rate in India is 6% and in the US is 2%, foreign investors may prefer to hold more US dollars, leading to an appreciation of the dollar against the rupee.

Interest Rates

Central banks in both countries set interest rates. Higher interest rates in the US attract foreign investors looking for better returns on their investments. When foreign investors buy US – denominated assets such as bonds, they need to convert their local currency (in this case, Indian rupees) into US dollars. This increased demand for dollars causes the dollar to appreciate against the rupee. Conversely, if the Reserve Bank of India raises its interest rates, it may make Indian assets more attractive, leading to an increase in the demand for rupees and a depreciation of the dollar against the rupee.

Gross Domestic Product (GDP) Growth

A higher GDP growth rate in a country generally indicates a strong and growing economy. If the US economy is growing at a faster pace than the Indian economy, it can lead to an increase in the value of the dollar. A growing US economy attracts more foreign investment, which in turn increases the demand for the dollar. On the other hand, a slowdown in the Indian economy may lead to a decrease in the value of the rupee as investors may be less willing to hold rupees.

Political Stability and Geopolitical Events

Political Stability

A politically stable country is more attractive to foreign investors. The United States, with its relatively stable political system, often sees a steady inflow of foreign investment. In contrast, political unrest or uncertainty in India can lead to a decrease in the value of the rupee. For example, if there are major political protests or a change in government that creates policy uncertainty, foreign investors may pull out their investments, reducing the demand for rupees and causing the rupee to depreciate against the dollar.

Geopolitical Events

Events such as trade disputes, wars, and international sanctions can have a significant impact on currency exchange rates. For instance, if there is a trade war between the US and another major trading partner, it can disrupt global trade flows. This can affect the Indian economy as well, since India is part of the global trading system. If the US dollar strengthens due to its status as a safe – haven currency during a geopolitical crisis, the Indian rupee may weaken against it.

Currency Exchange Services

Remittance Services

If you need to send money from the US to India, remittance services can be a good option. Services like Western Union, MoneyGram, and PayPal allow you to transfer dollars, which will then be converted into Indian rupees and delivered to the recipient in India. These services are convenient for sending money to family and friends. However, they may charge fees based on the amount of money being transferred and the delivery method. For example, Western Union may charge a flat fee for a small transfer and a percentage – based fee for larger amounts.

Research and Compare Rates

Don’t just settle for the first exchange rate you see. Take the time to research and compare rates offered by different banks, currency exchange services, and online platforms. You can use currency exchange rate comparison websites to easily see the rates offered by various providers. For example, you can check websites like XE.com, which not only shows the current exchange rates but also provides historical data and charts that can help you analyze trends.

Avoid Last – Minute Exchanges

If possible, avoid exchanging your currency at the last minute, especially at airports. Airport currency exchange booths usually have the least favorable rates due to their convenience factor. Try to exchange a portion of your money before you travel or find a local bank or currency exchange service in the city where you are located. For instance, if you are traveling from the US to India, exchange some dollars into rupees at your local bank in the US before you leave, and then exchange the rest at a more competitive location in India.

Consider the Timing

Exchange rates are constantly changing, so timing can be crucial. Keep an eye on economic news and events that may affect the dollar – rupee exchange rate. For example, if there is news about a potential interest rate hike by the US Federal Reserve, it may cause the dollar to appreciate. If you can anticipate such events, you may be able to exchange your dollars at a more favorable rate. However, predicting exchange rate movements accurately is very difficult, so it’s also important not to take unnecessary risks.

Use Fee – Free Options

Some banks and online platforms offer fee – free currency exchange services. For example, some online banks may not charge any commission for currency exchange if you meet certain criteria, such as maintaining a minimum balance in your account. Look for these fee – free options to maximize the amount of rupees you receive for your dollars.

Conclusion

Converting US dollars to Indian rupees involves a combination of understanding the basics of currency exchange, being aware of the factors that influence the exchange rate, choosing the right method of conversion, and following tips to get the best rate. The exchange rate between the dollar and the rupee is constantly in flux due to economic, political, and geopolitical factors. Whether you are a traveler, a businessperson, or an investor, having a good understanding of these aspects can help you make more informed decisions when it comes to currency conversion.

By exploring different methods such as banks, currency exchange services, and remittance services, you can find the option that best suits your needs in terms of convenience, cost, and security. Remember to do your research, compare rates, and consider the timing of your currency exchange to ensure that you get the most value for your money. With a little knowledge and careful planning, converting dollars to Indian rupees can be a smooth and cost – effective process. Whether you are sending money to India, traveling there, or making business transactions, being well – informed about currency exchange will help you navigate the financial aspects with confidence.

Related topics

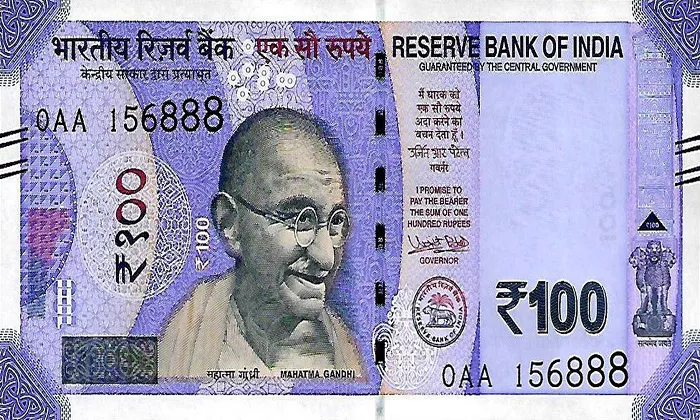

- Who is on the 1000 Rupee?

- Current SEK Exchange Rate: How Much is Krona to Rupee?

- Which Countries Use Indian Rupee?